PETALING JAYA: Sunway Real Estate Investment Trust (Sunway-REIT) remains optimistic for 2024, while stating a more stable domestic political landscape and the promise of economic reform will be positive for the long-term prospects of the economy.

The trust is generally optimistic about its retail and hospitality segments but more reserved about the outlook for office sector due to the supply overhang which will adversely affect rental prospects in the Klang Valley.

For the first quarter of fiscal 2024 ended March, Sunway-REIT’s net profit contract by 10% year-on-year (y-o-y) to RM87mil as revenue slid by 2.3% to RM178.6mil.

It attributed the decrease in both profit and turnover to the decline in net property income by RM7.8mil, primarily attributed to the absence of rental income from Towers A and B of Sunway Medical Centre of RM6.6mil following the completion of its disposal on Aug 30, 2023.

Higher property operating expenses for its retail segment due to increased marketing cost for festive decoration during the quarter as well as marginal allowance for doubtful debts also contributed to the marginally smaller earnings.

However, compared to the immediate preceding three months ended Dec 31, 2023, earnings actually rose 12.1% from RM77.6mil, despite turnover dipping by 6.3% from RM190.5mil, with Sunway-REIT attributing the better profit showing to the improved performance of its retail segment.

“Higher interest income and lower finance costs also contributed to the quarter-on-quarter improvement, although it was partially reduced by lower income from the hotel segment,” it said in a filing with Bursa Malaysia yesterday.

The investment trust did not declare any dividend for the quarter.

Sunway-REIT is confident Malaysia’s domestic consumption will be supported by low unemployment and reasonable economic growth, while hopeful of stronger tourist arrivals.

“In addition, we anticipate the impact of the implementation of high value goods tax and an increase in sales and service tax from 6% to 8% to be minimal,” it said.

Of interest, it projected the supply of retail malls in Malaysia to rise further this year, noting that while this will represent new competition, new retail malls could add depth and breadth to retail offerings and elevate Malaysia’s position as a retail destination.

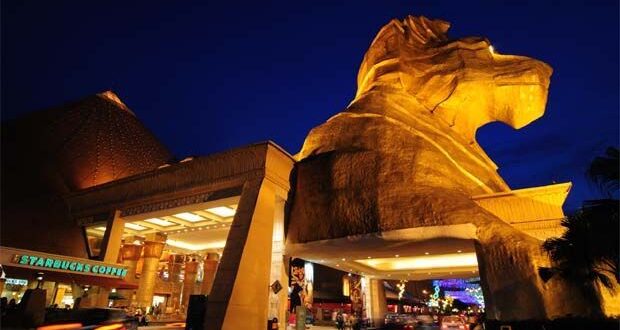

Moreover, Sunway-REIT added Malaysia’s strategic positioning in the Muslim-friendly and medical tourism segments bodes well for its hotels which are in close proximity to Sunway Medical Centre and surrounding hospitals.

“Given these positive factors, we are confident in a sustainable growth trajectory for the hotel segment in fiscal 2024, supported by full-room inventory at Sunway Resort Hotel,” it said.

To meet the challenges of the office supply overhang and to ensure its office properties are included in renters list for consideration, the investment manager said will continuously enhance its properties to meet green building requirements as well as achieve Malaysia Digital status.

Against the backdrop of supply outstripping demand, it predicted rental rates and occupancy rates for the office segment will remain challenging, but is nonetheless confident the contribution of the office segment in its portfolio will remain stable in FY24.

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia