KUALA LUMPUR: Export recovery and impact from elevated interest rates as well as inflation will continue to shape Asia Pacific’s (APAC) growth across the economies this year, said S&P Global Ratings.

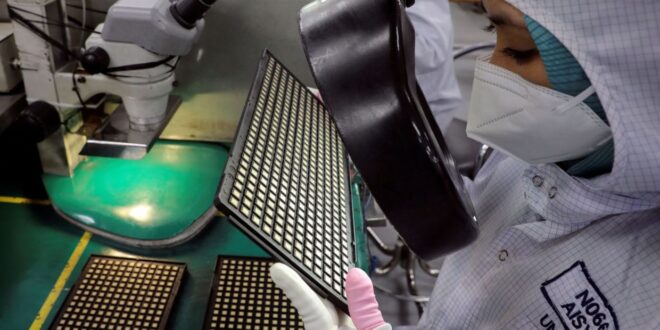

The credit rating agency said the export recovery, which was initially visible in northeast Asian semiconductor shipments, has expanded to other sectors and economies.

“Export volumes are on the rise, sequentially, in China and several Southeast Asian countries.

“We expect global demand growth to increase materially this year, in part because of an end to destocking in major economies,” it said in its “Economic Outlook Asia-Pacific 3Q 2024: Exporters and Emerging Market (EM) are Outperforming” report.

S&P Global said the increase in exports will lead to higher gross domestic product (GDP) growth in Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam in 2024.

“Other economies should also benefit from stronger exports,” it said.

However, it expects Japan’s GDP growth to slow down in 2024 as elevated inflation affects real incomes and consumption, while in Australia, restrictive interest rates are set to put a damper on its GDP growth.

Nonetheless, their resilient labour market would help to ease strains on growth.

As for other EM markets, solid domestic demand growth and a pick-up in exports should drive robust growth, with the Philippines and Vietnam projected to expand by almost six per cent and Indonesia by almost five per cent.

Meanwhile, the prospect of higher-for-longer United States’ (US) policy rates means less monetary policy easing in APAC, thus weighing on domestic demand.

It noted that with interest rates likely to start falling only late this year, the positive impact of monetary easing on growth will not kick in until 2025.

“Having said that, the resilience of the US economy is the reason for delays in its rate cuts and this is in itself a positive for APAC exports and growth.

“Overall, we project 5.1 per cent growth in 2024 in the region (excluding China and Japan), compared with 5.4 per cent in 2023, and 5.2 per cent in 2025,” it added. – BK

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia