PETALING JAYA: A PKR lawmaker has refuted the misleading viral message circulating on social media comparing the Employees Provident Fund (EPF) and Permodalan Nasional Berhad (PNB) dividend payouts.

Petaling Jaya MP Lee Chean Chung explained that the EPF’s investment approach involves a combination of bonds with a 2.5% guaranteed return and investments in both Malaysian and international public equities.

Lee clarified that while these diversified investments may yield mixed returns, they do not influence decisions regarding investments in private and government infrastructure by government-linked investment companies (GLICs) like Khazanah, PNB, and Ekuinas.

He also disclosed that EPF achieved its highest dividend payout in 2023, totalling RM57.8bil, a significant increase from the previous year’s payout of RM51.9bil.

“The factually erroneous and ill-intended message aims to play into the Malay versus non-Malay sentiments of English readers and divide Malaysians,” he stated on Facebook on Monday (March 4).

According to Lee, EPF’s primary role is to ensure favourable returns for pensioners.

“A comparison of dividend payouts between EPF and PNB reveals that EPF has consistently performed well, with EPF’s dividend payouts surpassing PNB’s since 2020.

“The spread of misleading information attempting to stoke divisive sentiments is unjust and undermines the years of hard work by EPF employees,” he said.

Lee highlighted that despite various withdrawal schemes, EPF has maintained a stable dividend rate ranging from 5.2% to 6.1% over the past five years. “This reflects the robust performance of EPF’s investment team in preserving the financial security of its members,” he added.

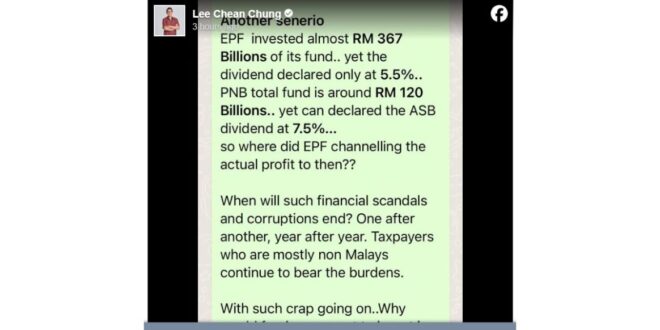

A recent viral message has sparked controversy by raising questions about EPF and PNB dividend payouts, alleging a significant disparity in returns.

The message stated that EPF, with an investment of nearly RM367bil, declared a dividend of only 5.5%, while PNB, with a total fund of around RM120bil, declared a higher dividend of 7.5% for Amanah Saham Bumiputera (ASB).

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia