MALAYSIA’S elaborate five-year roadmap to enhance funding for small businesses has drawn a wide range of opinions, both positive and negative.

Some praise the plan, calling it a much-needed initiative. Some question whether such funding gaps really exist. Others feel that the plan misses the point of strengthening the small business base.

First the praises.

The government and the Securities Commission (SC) have recognised the importance of enhancing the country’s base of micro, small and medium enterprises (MSMEs) and mid-tier companies (MTCs), points out Danny Wong of Areca Capital.

“These are companies that after all have the potential to become giants. Traditionally, the focus has been on the larger listed entities. But as we have seen in the last 10 years, there has been a rise in start-ups, mainly from markets like the US, which have expanded across the globe.

“This is why we need to bring early-stage home-grown companies into a more sustainable growth path and part of that is in their funding requirements,” he says.

The new plan by the SC resonates with Wong and his boutique asset management firm Areca Capital, which has been pioneering investments into unlisted digital start-ups, something which is new to individual investors in Malaysia.

No wonder Wong is proposing that more unit trust companies launch MSME and MTC-focused funds, which will go some way in providing fresh capital to the latter group of companies, aside from what is already available through equity crowdfunding (ECF) and peer-to-peer (P2P) lending.

Economist Lee Heng Guie expresses a similar view. “Financing remains severely restricted for MSMEs, which means that they can’t expand, innovate, or take risks.

“The SC’s launch of the five-year roadmap is timely. The characteristics embedded in MSMEs, asymmetric information flows and market infrastructure, and the banks’ lending behaviour, as well as their stringent loan valuation and criteria, contribute to the intertwined impact on the MSMEs’ finance gap,” he points out.

On the other hand, some question if there really is such a big financing gap for small companies.

As StarBiz7’s leader last week pointed out, almost all banks in Malaysia have placed much emphasis on funding the medium-sized company or SME segment.

Malaysia also has loads of companies that get listed on the ACE Market and an equal amount of capital is raised annually from licensed P2P lending platforms.

Additionally, the government has over the years spent billions of ringgit to fund SMEs via government agencies such as Malaysia Venture Capital Management (Mavcap), Cradle Fund, Ministry of Science, Technology and Innovation (Mosti), Malaysia Debt Ventures, Ekuinas and MSC Ventures. Some of those investments have resulted in success stories.

But the SC puts the funding gap for MSMEs and MTCs at a massive RM290bil as at 2022, basing this on data provided by PwC which in turn used methodology of the International Finance Corporation along with data from the International Monetary Fund.

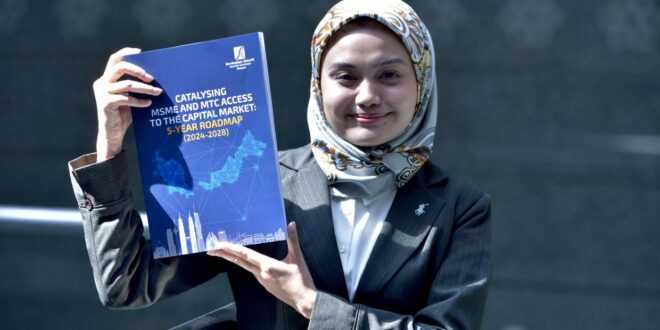

The SC also says it conducted one-on-one interviews, conducted workshops and used questionnaires when developing the roadmap. The five-year plan hopes that RM40bil will be raised for this group of small companies.

For Prof Geoffrey Williams, an economist and policy specialist, the whole plan does not make sense.

“For decades, Malaysia has had policies and programmes pushing money, interference and support to MSMEs and for decades the progress has been slow. The new policy plan appears no different in terms of effectiveness,” he writes in his op-ed for StarBiz7.

“There are many reasons, unrelated to a ‘funding gap’ or an absence of policy interference, which stop MSMEs from accessing funding. It is simply not provided in the way they want or need,” he adds.

He concludes: “Instead of same old patronage cascades, a new policy of low tax, low regulation, low interference is required to revitalise, reenergise and rejuvenate Malaysian MSMEs and MTCs.”

Another group of market participants reckons there is an anomaly in the thinking of the regulators. On the one hand, the SC is focused on boosting access to capital for small companies, yet on the other, the capital market regulators tend to make it harder for small companies to list on the equity markets.

According to a lawyer who advises small businesses, when applying for a listing on the ACE Market, for example, there is no requirement that a company must have a profit track record. Regulators, however, have made an unwritten rule that companies need that track record to apply for a listing.

Furthermore, the regulator has begun consulting advisers on tightening reverse takeover guidelines. This will make it more difficult for listed companies to undertake acquisitions and diversify their businesses. All of this makes it harder for small companies to raise funds on the capital markets.

As we pointed out in our leader article last week, while the regulator’s role is to ensure the integrity of the market, the question is, are our regulators still taking a protective stance and less of a buyer-beware attitude in our capital market?

This article first appeared in Star Biz7 weekly edition.

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia