KUALA LUMPUR: The growth of Malaysia’s semiconductor industry in the second half of 2024 will be gradual despite high hopes and optimism shown at the start of this year.

The World Semiconductor Trade Statistics has projected the annual global sales will post an increase of 16% this year and 12.5% in 2025.

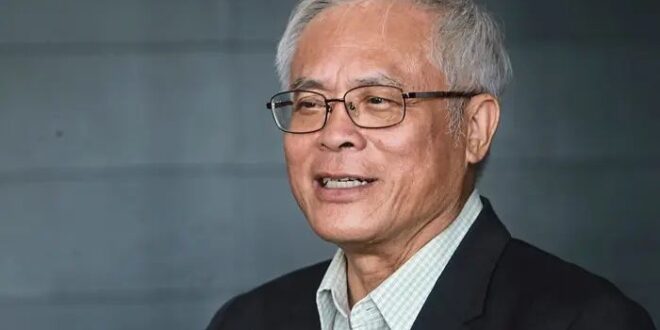

Malaysia Semiconductor Industry Association president Datuk Seri Wong Siew Hai told StarBiz that unfortunately, Malaysia is still lagging behind.

He said the electrical and electronics (E&E) sector’s exports fell 1.9% from January to May this year compared to the same period in 2023.

“If we are looking to grow, we should be growing at par or slightly higher.

“But we didn’t and now most of us are talking about the second half because we feel the demand has sort of flattened and we should focus on the next half of anticipated growth,” he said.

He was speaking at the 17th Bursa-HLIB Stratum Focus Series – Semicon: Light at The End of The Tunnel conference yesterday.

According to Wong, there are signs that the industry is returning, albeit slowly.

“It’s a matter of now going into the third quarter and seeing how quickly the growth comes on. It could be a gradual comeback but we definitely foresee next year to be stronger,” he said.

On why Malaysia has lagged behind, Wong said that artificial intelligence (AI) drives the industry and the number of AI projects locally showed that it is not sufficient for this to be a key driver at the moment.

“Names like Intel are building their fabrication plants but they are not bringing in the volume just yet.

“In a year or two, we will see that coming on, it is still early days,” he said.

Wong added that while it is good news Malaysia has by far attracted many world-renowned players in the semiconductor industry, there is urgent need to propel local-based companies so that the industry can move from just being at the back-end.

He noted that local companies are very strong in the assembly test area ,which is relatively high-tech.

However, what is needed to shift the industry to the next level is the advanced packaging segment.

“Companies like Intel and Infineon Technologies have invested in Malaysia to go into this segment, so they are building the capability here.

“But the question remains – do Malaysian-owned semiconductor companies have it? I say not quite, we still have very basic advanced technology,” Wong said.

He added that in countries like China, whose semiconductor industry has been around for some 30 years compared to 50 over years in Malaysia, their local champions have spurred the industry forward.

“The question is how to build local champions, then help them become global players. It’s not that we don’t have any local companies but they’re not big enough to be on the global platform yet,” he said.

He added that to hit internal targets for investment, he hoped to see more coming from domestic direct investments (DDIs) rather than foreign direct investments (FDIs).

“We need to grow this more, maybe 10% of DDI in every couple of years. Right now, the gap between both is very imbalanced. FDI is obviously way higher.

“If we can build that aspiration, we can maintain our position and goal of becoming a hub for the region,” he added.

Meanwhile, Wong said the task of finding and retaining talent has long been a sore point for the semiconductor industry, not just here but globally.

He said some companies are looking for very specific skills thus making it harder to find the people they need.

He also said it is hard to define the issues in hiring today, be it competency levels, skills or others

For the industry, Wong said he expects hiring to start on a bigger level by the end of this year or early 2025.

Another challenge correlated to talent is the global competition, whereby many other countries have proposed plans and set high goals that could impact Malaysia’s industry growth.

“China aims to be self-sufficient by 2030. There has been US$150bil in semiconductor investment through the Made In China 2025 programme.

“Europe plans to double its share of the global market to 20% by 2030 and Japan wants to double its revenue to US$114bil by 2030.

“These are just a few of the countries that have set their targets,” he said.

But rather than view each country trying to have a slice of the pie as a competitor, Wong said he would rather work with them to complement each other on strengths and weaknesses.

“For example, Brazil has a vibrant semiconductor industry. We are actually speaking to them to see how we can collaborate to support each other.

“We’ve had discussions with the UK about technology. We can leverage each other. There will always be friendly competition but why not work together first as a whole,” he said.

Wong echoed what Investment, Trade and Industry Minister Tengku Datuk Seri Zafrul Abdul Aziz had said in his speech, that this is a one generation opportunity Malaysia should capture.

“It is critical because if we miss it, it is gone. Developing strategic plans that can be implemented and move the industry is important. There is still much to be done.”

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia