PETALING JAYA: The key focus in the healthcare sector in 2024 will largely revolve around the resiliency of its earnings delivery and how the companies navigate around inflationary pressures.

“We continue to like the healthcare sector given its ability to deliver sustained earnings in times of high inflation and economic slowdown, given the rising demand,” said Affin Hwang Investment Bank Research.

“The relatively consistent earnings delivery vis-a-vis other sectors should garner investor interest,” it said in a report.

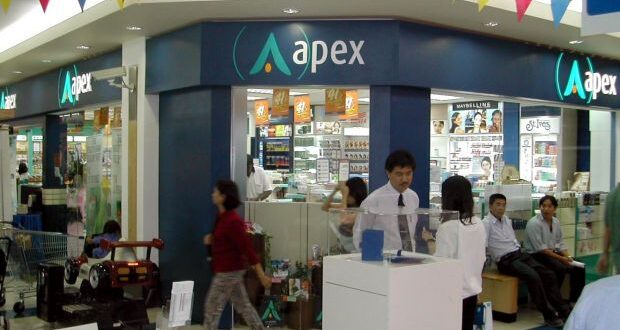

The research house believes earnings growth will be seen across stocks under its coverage, except for Apex Healthcare Bhd, for 2024, on the back of higher inpatient volume in hospitals coupled with stronger manufacturing contributions for contract manufacturers.

However, it added that earnings delivery will be dependent on various factors.

These include occupancy of hospital operators, revenue intensity per patient of hospital operators and the extent of inflationary pressures.

The research house added that other factors include demand for products of manufacturers as well as associated expansion pipelines.

Affin Hwang remained “overweight” on the sector given its consistent earnings delivery amid the rising demand for healthcare products and services.

“We are optimistic on the demand for healthcare products and services to be on the rise amid increased health awareness post-pandemic.

“New competition within the space should be limited in the near term due to the highly regulated nature of the sector,” it said.

Its top sector “buys” are unchanged for KPJ Healthcare Bhd with a target price (TP) of RM1.60, mainly due its cost optimisation efforts coupled with ongoing inpatient volume growth.

The research house also has a “buy” call on IHH Healthcare Bhd with a TP of RM6.70.

“For hospital operators (KPJ and IHH), ongoing improvements in inpatient volumes are expected to continue driving earnings growth, with KPJ further benefiting from cost optimisation efforts previously carried out, coupled with the ongoing divestment initiatives of its loss-making foreign ventures,” it added.

Affin Hwang also favours UMedic Group Bhd (UMC) with a TP of RM1 due to its earnings growth trajectory from its recent expansion.

The largest year-on-year growth in earnings comes from UMC, given its recent expansion and strong demand for its pre-filled humidifiers (financial year 2024-2026 earnings growth estimated in the range of 13% to 27% per annum).

However, the research house has a “hold” call on Apex Healthcare (TP: RM2.40).

“We have pencilled in an earnings decline for Apex Healthcare as we expect demand for its consumer healthcare products to slow down coming off from a high base of the post-pandemic demand,” it added.

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia