SYDNEY: Morgan Stanley plans to use artificial intelligence (AI) capabilities to manage rich people’s portfolios in Australia as the Wall Street bank roll outs more software in the country that’s used in other parts of the world.

“Other regions are a little bit more established. It’s a real opportunity for us to bring some of the leading ideas we have learned from overseas markets to Australia,” Morgan Stanley’s head of wealth management for Australia, Rebecca Hill, said in an interview with Bloomberg TV yesterday in Sydney.

The decision comes as the value of high-net worth individuals in Australia rose about 8% last year and now exceeds US$1 trillion for first time, according to a Capgemini report last week.

Morgan Stanley in March appointed its first global head of AI as banks around the world seek to capitalise on potential cost savings.

“On the whole Australia is a more maturing market. We are starting to become more sophisticated as investors, but it’s still very early days,” Hill said, speaking on the sidelines of the Morgan Stanley Australia Summit.

As a result of such initiatives and overall growth in assets under management in line with a strong local economy, the firm has plans to add more headcount, Hill said.

She didn’t specify how many staff the wealth business might add.

Morgan Stanley is already the largest global wealth management provider in Australia, with more than A$41bil (US$27bil) in client assets, according to its website.

The firm has more than 100 financial advisers in five branches across the country working with high net worth individuals, family offices and not-for-profits.

Morgan Stanley chief executive officer Ted Pick earlier said AI could help its financial advisers save up to 15 hours a week.

The bank’s been beefing up its wealth operations in Asia-Pacific for years, after integrating the business with the firm’s institutional securities group.

Globally, the wealth business has been a star performer and cemented its increased importance by posting better-than-expected revenue in the first quarter.

The unit is just months into new leadership after Jed Finn was appointed to run the US$4.8 trillion business in November.

Meanwhile, Morgan Stanley’s Australia chief Richard Wagner said the country is benefitting from an increase in capital flows that cements its ability to cushion investment risk during a period of global turbulence.

“It’s very, very hard to lose money in Australia and therefore that safe haven has been an attraction of capital, particularly in the last 12 months as we’ve seen such extended volatility in China,” Wagner said in a Bloomberg TV interview yesterday.

“Most of the global money that’s been pointed at Asia-Pacific has been reweighted away from China. And the beneficiaries of that have been Australia, Japan and India.”

Deal activity in Australia is improving month by month, Wagner said, with the bank expecting a pick up in activity as investors get more clarity on the trajectory of global interest rates and the US presidential election.

“The rabbit hasn’t jumped out of the hat quite yet, but every month gets better,” he said, speaking to Bloomberg on the sidelines of the Morgan Stanley Australia Summit in Sydney.

That follows a “couple of tough years in investment banking”, he added.

Morgan Stanley’s Pick, who took over from Australian-born James Gorman at the start of this year, has pledged to keep meeting the firm’s goals in the wealth business while unlocking additional gains in investment banking.

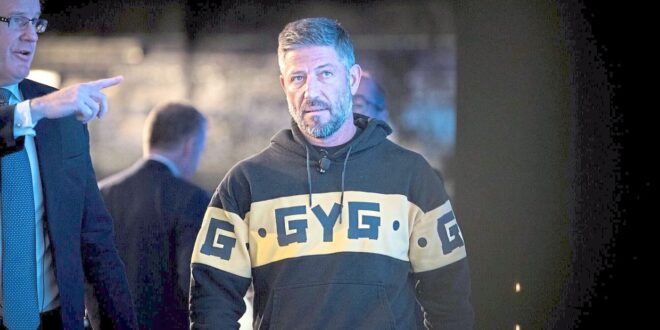

In Australia, Morgan Stanley has nabbed a lead manager role on the initial public offering (IPO) of Mexican food chain Guzman y Gomez, the first large IPO in years, while advising troubled real-estate developer Lendlease Group on its breakup plans.

Adding to Australia’s relative strength is an economy that Wagner – like Treasurer Jim Chalmers – is betting will not enter a recession, in part due to the windfall from the country’s resources export base and historically low unemployment. — Bloomberg

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia