KUALA LUMPUR: Shares in Mr D.I.Y Group Bhd fell 1% in early trade Friday despite posting earnings that are in line with analysts’ estimates.

The home improvement retailer declined 1.12%, or two sen to RM1.77 with 4.93 million shares traded.

Mr DIY chalked in the first quarter ended March 31 (1Q24) revenue of RM1.1bil and core net profit of RM144.8mil.

“This accounted for 22% of ours and 23% of consensus full year forecasts which we deem to be broadly in line,” Hong Leong Investment Bank Research said.

The research house noted that Mr DIY has opened 37 new stores to date, with the majority of them being Mr DIY stores. This slightly lagged behind, making up 21% of the group’s target of 180 additional stores for FY24.

“Management assured that they will be able to catch up on the store expansion with a focus in East Malaysia in line with the group’s efforts to close the gap and broaden its reach. The group remains focused on the expansion of its store network, optimising revenue per square foot and operational efficiency to drive financial performance.

“Furthermore, we opine that Mr DIY is poised to benefit from the recent government announcement of a new flexible EPF account and civil servants’ pay rise. Maintain ‘buy’ with an unchanged target price of RM2.11 based on 30x PE of FY24 EPS,” HLIB said.

“We remain optimistic on the group strategy of store expansion to defend its market share as the leading home improvement retailer,” it added.

Meanwhile, Kenanga Research said Mr DIY’s 1Q24 net profit of RM145mil met expectations, coming in at 22% and 23% of the house’s full-year forecast and the full-year consensus estimate, respectively.

The research house also noted that the retailer is on track to add 180 new stores in FY24 and it believes the demand for its affordable hardware and household products will be buoyed by the introduction of EPF’s Account 3 and an upcoming revision in civil servant wages.

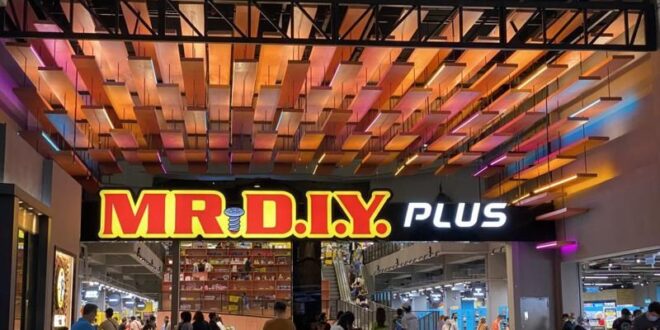

“The recently opened second largest MR DIY PLUS store in Mutiara Damansara, which combines three of its brands, i.e. MR DIY, MR DOLLAR, and MR TOY, under one roof, has seen positive sales momentum since April 2024. The company has also reached an agreement with IKEA to open MR DIY PLUS stores in all IKEA malls nationwide,” Kenanga said.

“We keep our forecasts relatively unchanged. Our forecasts assume net outlet additions of 180 each and same-store sales growth rates of 1% and 2% in FY24 and FY25, respectively,” Kenanga said.

It has maintained its “outperform” call on Mr DIY with a higher target price of RM1.97 from RM1.95 previously.

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia