(Reuters) – For chip designer Nvidia, the generative artificial intelligence boom is the gift that keeps on giving.

After riding a demand surge sparked by Big Tech’s rush to roll out chatbots, Nvidia now expects new AI models that are capable of creating video and engaging in human-like voice interactions to spur more orders for its graphics processors.

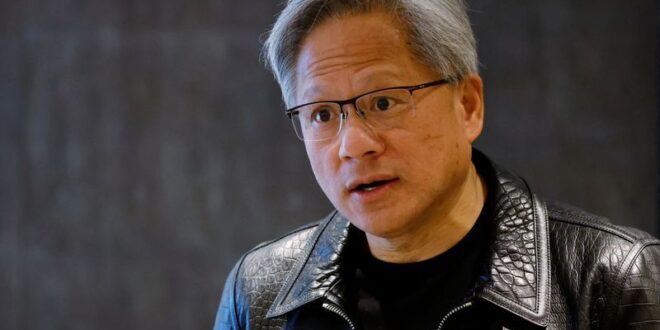

“There’s a lot of information in life that has to be grounded by video, grounded by physics. So that’s the next big thing,” Nvidia CEO Jensen Huang told Reuters on Wednesday.

“You’ve got 3D video and you’ve got a whole bunch of stuff you’re learning from. So those systems are going to be quite large.”

The need for more computing power to train and run advanced AI systems has buoyed demand for Nvidia’s Grace Hopper chips such as the H200, which was first used in OpenAI’s GPT-4o – a multimodal model capable of realistic voice conversation with the ability to interact across text and image.

Nvidia’s other customers, including Google DeepMind and Meta Platforms, have also released AI image or video generation platforms.

The chipmaker on Wednesday forecast quarterly revenue far above estimates, after clocking more than five-fold growth in sales at its data center unit in the first quarter.

“The demand is broad based and the large language models need to be increasingly multimodal, understanding not just video but also text, speech, 2D and 3D images,” said Derren Nathan, the head of equity analysis at Hargreaves Lansdown.

AI models for video used in the automotive industry are also emerging as a big driver of demand for Nvidia chips.

Tesla has expanded its cluster of processors used in AI training to about 35,000 H100s as it chases autonomous driving, Nvidia’s finance chief Colette Kress said on a post-earnings call on Wednesday.

Kress added that the automotive industry was expected to be the largest enterprise vertical in Nvidia’s data center business this year.

“It (video generation) is certainly one of the strong and already proven use cases for AI and it is extending beyond just content production,” Hargreaves Lansdown’s Nathan said.

(Reporting by Arsheeya Bajwa in Bengaluru and Stephen Nellis in San Francisco; Writing by Aditya Soni; Editing by Anil D’Silva)

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia