PETALING JAYA: Aluminium extruder P.A. Resources Bhd’s net profit for the nine months ended March 31, 2024 (9MFY24) has surpassed its financial year 2023 (FY23) full year results.

For 9MFY24, P.A. Resources’ net profit increased by 16% year-on-year (y-o-y) to RM32.4mil and revenue rose by 17% y-o-y to RM417.8mil.

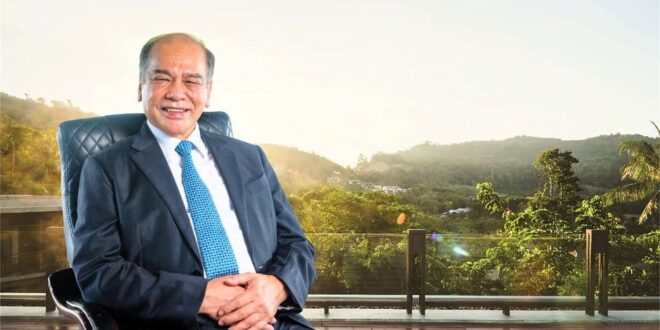

P.A. Resources group executive chairman Tan Sri Chan Kong Choy said this growth was mainly backed by an increase in orders from its clients.

“This remarkable achievement signifies a milestone in our journey towards sustainable growth and profitability. By surpassing FY23’s full year results in nine months of the current fiscal year, we once again demonstrated that we continue to improve and deliver value to our shareholders.

“The global target to achieve net-zero carbon emissions by 2050 is propelling demand for renewable energy. As we move forward, P.A. Resources is poised to capitalise on this paradigm shift and contribute to a more sustainable growth and adding value to all stakeholders,” he said in a statement.

Meanwhile, for the third quarter ended March 31, 2024 (3Q24), the group’s net profit jumped to RM12.4mil from RM239,000 in 3Q23, translating to earnings per share of 0.83 sen.

On a segmental basis, the company’s extrusion and fabrication division’s year-to-date revenue expanded by RM64.7mil y-o-y, due to higher customers’ order for both export and local sales, amounting to RM69.7mil, alongside a rise in Interco. sales totalling RM4mil.

However, P.A. Resources said this growth was offset by the adverse impact of the exchange rate, resulting in net decrease in revenue compared to the preceding year, amounting to RM9mil.

In the aluminium billet and tolling division, the company posted a year-to-date revenue growth of RM72.3mil. Operating profit increased by RM3.3mil, mainly due to higher profit from Interco.

Looking ahead, Chan said the group is committed to further enhance and place paramount importance on environmental, social and governance principles and practices as part of the ethos of its business strategy.

In January, P.A. Resources’ subsidiary, P.A. Extrusion (M) Sdn Bhd (PAE) renewed its supply agreement with First Solar Inc, First Solar Malaysia Sdn Bhd and First Solar Vietnam Manufacturing Co Ltd, valued at up to US$231.9mil until July 1, 2025 (renewal contract).

The group said capacity expansion was completed to meet the demands of this contract.

Additionally, in February, PAE entered into two sales and purchase agreements to acquire two industrial lands for RM21mil as part of P.A. Resources’ expansion plans, aiming to double production capacity with the construction of a new factory.

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia