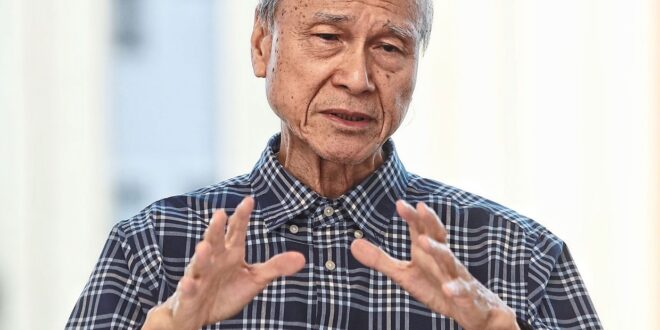

KUALA LUMPUR: Curbing scams against senior citizens should be a joint effort by the government, the business sector, communities and individuals, says Tan Sri Lee Lam Thye.

“The government should introduce stricter penalties for those convicted of scamming, including stiffer jail sentences.

“It should regularly update regulations and legislation to cover new forms of financial transactions.

“It should also make it mandatory for retail and other outlets to continue allowing traditional methods of payments even as they embrace digital currency,” the Alliance for a Safe Community chairman said on Friday (June 14).

He also encouraged senior citizens to check with one another during social gatherings and activities to stay up-to-date on scam tactics.

“While there is little hope of recovering the losses, something should be done to turn the tables on scammers,” he added when commenting on The Star’s front page report that the number of senior citizens being scammed had risen for the past three years.

Lee suggested that community centres and NGOs hold regular workshops to educate senior citizens on the new tactics used by scammers, teach them digital literacy, and how to tell genuine platforms from fake sites.

He noted that the increasing cases also revealed that scammers are constantly coming up with ways to tempt and trick naive retirees into parting with their EPF or other savings accumulated over decades of work.

Banks, telecommunications companies and technology firms should develop and promote security measures such as scam alert systems and more robust customer verification processes, he added.

“Traditional media and digital platforms could also be used to disseminate information about the latest scams and how to avoid them,” he suggested.

Lee said senior citizens should be encouraged to consult trusted family members or friends before making digital interactions, particularly financial transactions that promise the moon and the sky.

“In extreme cases, senior citizens should minimise the use of online banking, opting instead for in-person transactions wherever possible.

“Nowadays, it is not uncommon to see senior citizens getting together socially. When they do, they should check with each other before making financial decisions or pressing buttons on dubious apps on their mobile phones,” he said.

He also reminded senior citizens to scan the newspapers for stories of situations similar to what they may be facing and to keep abreast of technological advancements.

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia