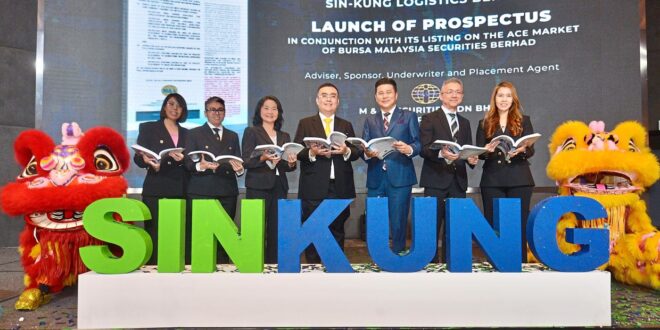

KUALA LUMPUR: ACE Market-bound Sin-Kung Logistics Bhd, which specialises in providing airport-to-airport road feeder services for both passenger and cargo airlines, aims to raise RM26mil through its initial public offering (IPO).

Managing director Alan Ong Lay Wooi said the integrated logistics provider, which is focused on high-value cargos, is poised to capitalise on the semiconductor upcycle and the eCommerce boom.

He said the factors are driving growth in air cargo volume and total container throughput in Malaysia.

“This will in turn create demand for trucking services, including airport-to-airport road feeder services and point-to-point trucking services, to facilitate the movement of electrical and electronics (E&E) products between, and to or from, airports,” he told a press conference in conjunction with the group’s prospectus launch here yesterday.

Ong added that the company serves nearly 60 airlines and operates 461 commercial vehicles.

While over 70% of its revenue is derived from trucking services, Sin-Kung is also involved in warehousing and distribution services, which contributed about 16% of its revenue in the financial year 2023.

It has allocated RM10mil or 38.6% of its total IPO proceeds towards funding the expansion of its warehousing and distribution services.

“They are in line to meet the rising demand from the manufacturing and eCommerce sectors,” Ong said.

The utilisation rate of its warehouses stand at between 70% and 80%.

Part of the RM10mil will go toward acquiring the Valdor Office and Warehouse in Penang, near Batu Kawan, purchased for RM70.6mil.

“This is an area where most of the E&E companies are based. Customers for the current warehouse in Penang are demanding more space,” he added.

This acquisition will see the group doubling its warehouse capacity, as the new Valdor Warehouse offers a larger annual storage capacity of 192,000 pallets.

It operates five warehouses, namely in Shah Alam and Port Klang (Selangor), as well as Bukit Mertajam, Butterworth, and Bukit Minyak, Penang, with a combined annual capacity of 190,260 pallets.

Applications for Sin-Kung’s IPO will close on May 2, with the listing slated for May 15.

At an IPO price of 13 sen apiece, Sin-Kung’s market capitalisation is expected to be RM156mil upon listing.

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia