PETALING JAYA: After diversifying its business to include a healthcare division in 2019, Matrix Concepts Holdings Bhd continues to seek further diversification of its income streams especially through the development of complementary business units.

Notably, in 2019, Matrix Concepts entered into a 30-year exclusive management agreement for the rights to operate Mawar Medical Centre (MMC), a specialist hospital.

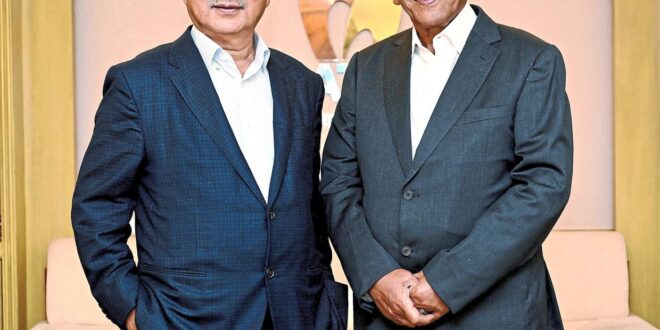

Chairman Datuk Mohamad Haslah Mohamad Amin said while the company remains a property developer, it would continue to diversify its income streams through the development of complementary businesses.

For the second half of its financial year 2024 (2H24), Matrix Concept recorded maiden profit contributions of RM5mil in management fees from its healthcare division.

“The initial contributions from Mawar Medical Centre exemplify this strategy, with the healthcare division expected to contribute approximately 5% to group earnings in the future,” Mohamad Haslah noted in a statement.

“We will continue to identify and secure quality land acquisitions and ventures that complement our existing operations, ensuring sustained diversification and expansion for the group, while remaining focused on delivering long-term value to our shareholders,” he added.

For the financial year ended March 31, 2024 (FY24), Matrix Concepts recorded a net profit of RM246.47mil, up from RM207.22mil in the previous year, translating to an earnings per share of 19.7 sen compared to 16.56 sen respectively.

This is the group’s second-highest reported net profit since its listing in 2013, after recording an all time high of RM259.93mil in FY21.The property developer attributed the growth in FY24 bottom line to the strong demand for its diversified property portfolio that caters to a wide range of homebuyer preferences.

Meanwhile, revenue in FY24 was up 20.4% to RM1.34bil from RM1.11bil in FY23, on recognition of residential and commercial properties, coupled with industrial property sales and increased contribution from the education and hospitality divisions.

During the year, Matrix Concepts registered healthy new property sales growth of 3.6% to RM1.25bil, on the back of residential double-storey homes, select industrial land parcels, as well as being complemented by projects in Klang Valley, Negri Sembilan and Johor.

As at end-FY24, the group has an unbilled sales of RM1.2bil, providing future earnings recognition over the next 15 to 18 months.

Mohamad Haslah said Matrix Concepts’ robust performance in FY24, coupled with a take-up rate exceeding 80% across its developments, underscored the resilience of their customer-centric business model.

“This success, coupled with our strong financial position and diversified income streams, has firmly established our brand and market leadership,” he said.

He said the success paved the way for the group’s next major growth catalyst, the upcoming 1,383-acre township development in Malaysian Vision Valley (MVV) in Negri Sembilan.

“With an estimated development timeline of seven to 10 years and projected gross development value of RM7bil, MVV represents a transformative opportunity for the group, poised to boost our revenue by over 30% in the coming years and strengthen our position as a leading property developer,” he added.

Looking ahead to FY25, Mohamad Haslah said the group is confident to continue delivering strong financial results and create long-term value for its shareholders.

For the fourth quarter ended March 31, 2024 (4Q24), Matrix Concepts saw its net profit rose by 15.9% to RM65.6mil compared with RM56.6mil in the previous corresponding quarter, spurred by robust demand for properties in the group’s flagship Sendayan Developments in Seremban, Negri Sembilan.

Meanwhile, 4Q24 revenue increased 17.1% to RM353.9mil from RM302.2mil previously, primarily due to higher revenue contribution from the property development segment.

The segment’s revenue improved 17.5% to RM342.5mil from RM291.6mil previously, led by increased sales recognition of residential, commercial, and industrial properties.

Notably, new property sales demonstrated strong growth in 4Q24, driven by positive sentiment from homebuyers, reaching RM286.6mil compared to RM202.2mil previously.

The majority 90% of new property sales was contributed by Sendayan Developments, while the balance came from Levia Residence in Klang Valley, as well as other projects in Negri Sembilan and Bandar Seri Impian in Kluang, Johor.

The group’s other business units, comprising its education and hospitality divisions, contributed revenue of RM11.4mil in 4Q24, an increase of 7.3% from RM10.6mil previously.

Matrix Concepts has declared a fourth interim dividend of 2.5 sen, bringing its total FY24 dividend to 10 sen per share, up from 9.25 sen in FY23, with a total payout of RM125.1mil or 50.5% of FY24 profit after tax.

BeritaKini.biz Berita Viral Terkini di Malaysia

BeritaKini.biz Berita Viral Terkini di Malaysia